Vxx Xiv Strategy - This is a test of our strategy trading XIV short volatility and VXX long volatility since mid-2004. One advantage is that you only lose the premium you pay even if VIX jumps significantly and XIV is wiped out XIV may be wiped out in an 80 intraday drop - whereas a VXX put will likely survive on a bounceback.

Our Strategy Trading Xiv And Vxx Volatility Made Simple

The VXX Bias strategy is based on the term structure and momentum of VIX futures while VRP is based on the price of VIX and historical volatility measurements.

Vxx xiv strategy. There are two halves of this trading strategy. Lets say that we bought VXX at 100 per share and we bought XIV at 100 per share. 3 VXX Instructor Background Degree in Engineering and MBA More than 10 years experience in Management Consulting Option trading for more than 6 years Volatility trading in the past 3 years - Started with XIV and SVXY buy ETNs - Evolved to volatility trading with options Currently trading exclusively VXX strategies - Since the beginning of.

2 Rebalance at the end of each year so that 50 of the portfolio is short VXX and 50 is short XIV. He provides us with his backtesting parameters. 2008 showed just how high VIX can go and theres no reason it.

However each of these strategies thrive and struggle depending on the specific market conditions. We spent 10000 on each purchase so we own 100 shares. So just for fun consider this strategy.

A simple yet untradable unstable VIX Strategy using two ETFsIt has a simple binary all or nothing allocation1. My own research shows this is very risky. After all front month VIX Future contango is about 2-3x bigger then medium term contango.

It seems that many people including myself not that long ago think buying XIV at high VIX levels or VXX at low VIX levels is a good trading strategy on its own. 28100 N Ashley Circle Suite 102 Libertyville IL 60048 Phone. Good protection for a potential flash crash.

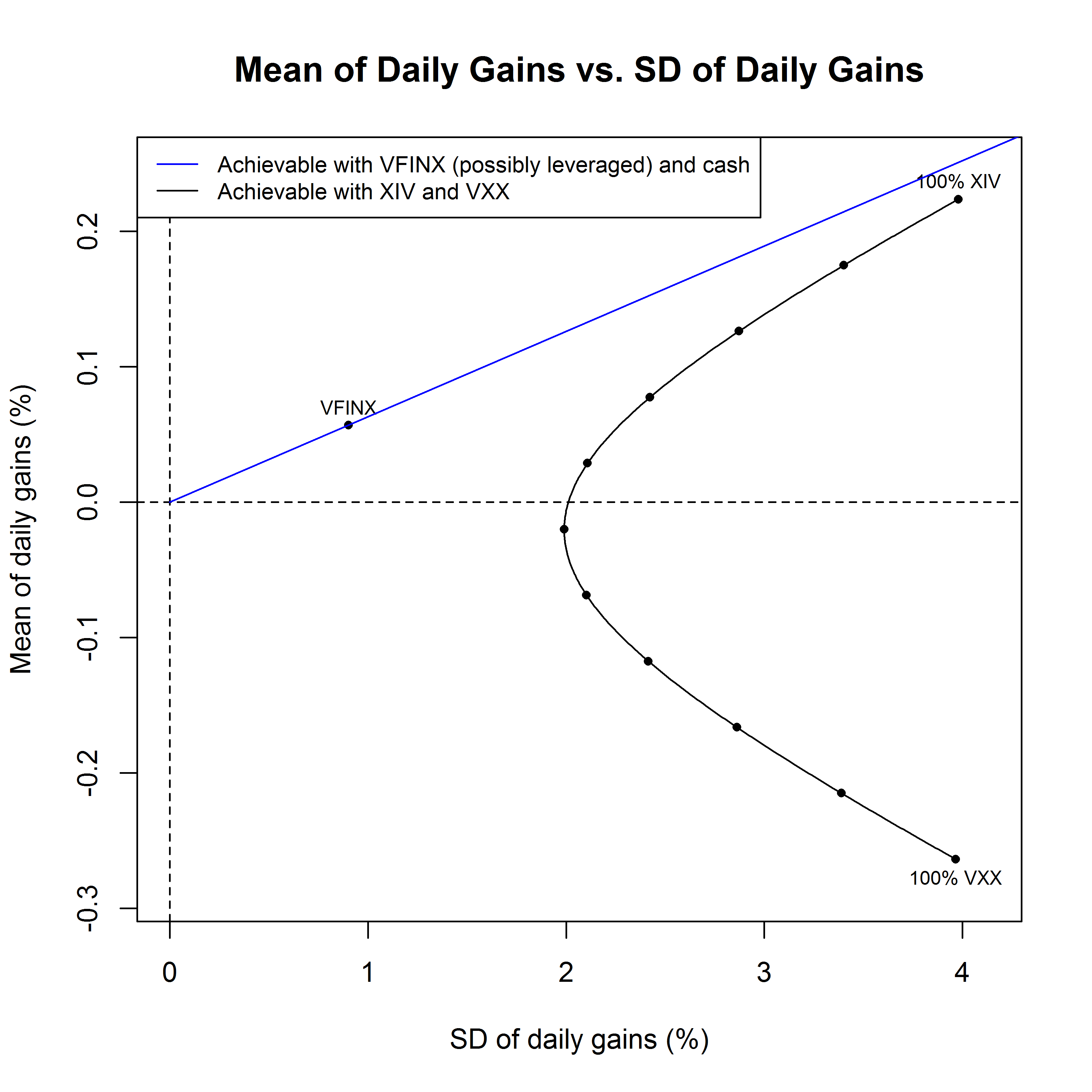

Seek to maximize the roll yield by investing in XIV when the VIX term structure is in contango and in VXX when the term structure is in backwardation. The concepts behind our strategy are complex but following our strategy is simple. Thus a short position establishes a bet against volatility.

Short vol buy XIV3. There are variation of the signals. 1 Sell short both ticker VXX and ticker XIV.

As its name suggests VXX is a direct trade on volatility trending upwards when volatility increases. Posts about VXX written by fgrossmann. Essentially we alternate going long on VIX long VXX when a certain metric is below 1 and going short on VIX long XIV when that metric is above 1.

The metric is defined as. Because VXX is the inverse of the funds XIV and SVXY the VXX Bias forecast applies to those securities as well but the negative needs to be changed to a positive or vice versa. On the other hand XIV is an.

Strategy 3 - Contango-Backwardation Roll Yield. 2 being long VXXUVXY or short XIV whenever the WRY is above its moving average. Further documentation of b acktested results using the VXX Bias strategy is available in this post-----.

If VXV VIX invest in XIV. Full access for just 1 day - check it out now. 847-816-6610 OptionVue DiscoverOptions and The VXX Trading Systems are all products of Capital Allocation LLC Please visit all our web sites at.

The VXX Bias and VRP strategies each take a very different approach for maximizing gains. Subscribers receive each days signal prior to the market open and enter orders at any point in the day for automatic. We average less than one trade a week.

NoneSignal is just the standar. If VXV VIX invest in VXX. VXX XIV and the VIX level.

The VXX Trading System is a product of Capital Allocation LLC Capital Allocation LLC. Several times I have been asked why we invest in ZIV inverse mid-term volatility and not in XIV inverse front month volatility in our Maximum Yield Rotation Strategy and in the Global Market Rotation Enhanced Strategy. 1 being short VXXUVXY or long XIVSVXY whenever the WRY is below its moving average and.

Basic signal is clear and straightforward. Long vol buy VXX 2.

Change Is In The Air Next Exit Digital Marketing Trends Limiting Beliefs Marketing Trends

A Momentum Rotation Strategy For Trading Vix Etps Volatility Made Simple

Here Is Why You Shouldn T Forecast The Vix For A Vxx Trading Strategy A Backtest On Volatility Forecasting Models By Michael Dampf Medium

Pin On Writing And Blogging

Our Strategy Trading Xiv And Vxx Volatility Made Simple

Macro Investor S Vix Trading Strategy Volatility Made Simple

Our Strategy Trading Xiv And Vxx Volatility Made Simple

Pin On Our Posts

Long Xiv Vxx Strategies Are Ludicrous Bats Vxx Seeking Alpha

Pin On Our Strategies

Strategy Backtests Volatility Made Simple

Easy Investing In A Multi Strategy Markowitz Optimized Portfolio In Strategy Development Tools Wealth Management Tr Wealth Management Investing Portfolio

Strategies For Trading Inverse Volatility Logical Invest Volatility Trading Trading Strategies Strategies

Strategies For Trading Inverse Volatility Update You Can See The Most Recent Hedging Strategy Development Volatility Trading Strategies Trading Strategies